“Understanding Advance Tax in India: A Crucial System for Ensuring Timely Tax Payments”

a comprehensive understanding of advance tax in India,

Advance tax in India is a system under which taxpayers are required to pay a portion of their tax liability in advance, throughout the financial year, rather than paying the entire tax liability at the end of the year. The purpose of this system is to ensure that taxpayers have sufficient funds to pay their tax liability when it becomes due.

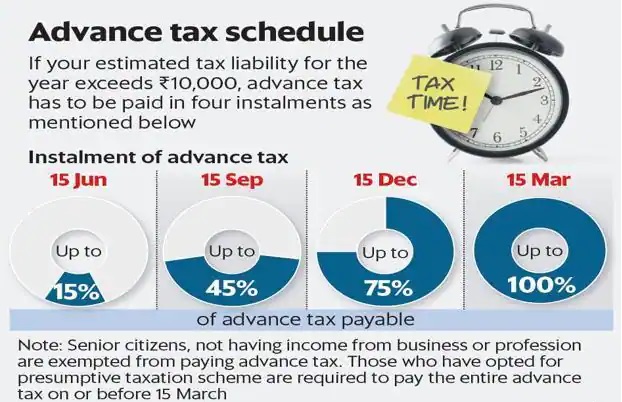

In India, advance tax is applicable to individuals, HUFs, firms and companies. The advance tax liability is calculated based on the estimated tax liability for the financial year. Taxpayers are required to pay advance tax in instalments, as per the following schedule:

15% of advance tax liability on or before 15th June of the financial year

45% of advance tax liability on or before 15th September of the financial year

75% of advance tax liability on or before 15th December of the financial year

100% of advance tax liability on or before 15th March of the financial year

If a taxpayer fails to pay the advance tax as per the above schedule, they may be subject to interest under section 234B and 234C of the Income Tax Act.

It’s important to note that the rules and regulations regarding Advance tax in India may change from time to time, and it is recommended to consult with a Chartered Accountant or Tax professional for the most accurate and up-to-date information.

In case of non-compliance of advance tax in India, the taxpayer may be subject to interest under section 234B and 234C of the Income Tax Act.

Under Section 234B, if a taxpayer fails to pay the advance tax as per the due dates specified, they will be charged interest at the rate of 1% per month on the unpaid amount of advance tax.

Under Section 234C, if a taxpayer fails to pay the advance tax as per the due dates specified, they will be charged interest at the rate of 1.5% per month on the unpaid amount of advance tax.

It’s important to note that if the taxpayer can prove that there was reasonable cause for not paying the advance tax on time, the interest may be waived by the tax authorities.

It’s important to note that the rules and regulations regarding interest for non-compliance of advance tax in India may change from time to time, and it is recommended to consult before paying with tax professionals like us. It’s always important to comply with the tax laws to avoid any penalties or interest.